The sharing revolution: financial shared services

What is financial shared services?

Shared Service SSC (Financial Shared Service Centre)

Shared Service Centre centralises some of the repetitive transactional routine(basic and non-strategic work) carried out by each member unit of the group in a relatively independent business unit. The scope of shared services mainly includes: finance, human resources, legal affairs, information technology, supply chain management, customer service and training, etc.

Financial Shared Services FSSC

It delivers an integrated and independent service delivery platform for all financial and administrative functions in a group company, which is originally dispersed in various subsidiaries.

Sharing is a revolution

Sharing is a new management concept: To integrate businesses that can be shared as services and establish a service centre, it allows as many business departments to share these services as possible to improve efficiency and reduce costs.

Sharing is a new organisational structure. Separate the non-core business of an organisation from the original organisation system and transfer it to a service department for unified operation. The decentralised cost centre will be transformed into a profit-driven and gradually expanding to be a business unit. The subsidiaries only focused on core business or business with high competitiveness and high added-value. It helps downsize organisation.

Sharing is a management change: It is not simply centralising and integrating the accounting functions, but also the result of the revolution of the corporate strategy, organisational strategy, talent strategy, technology strategy, and business strategy.

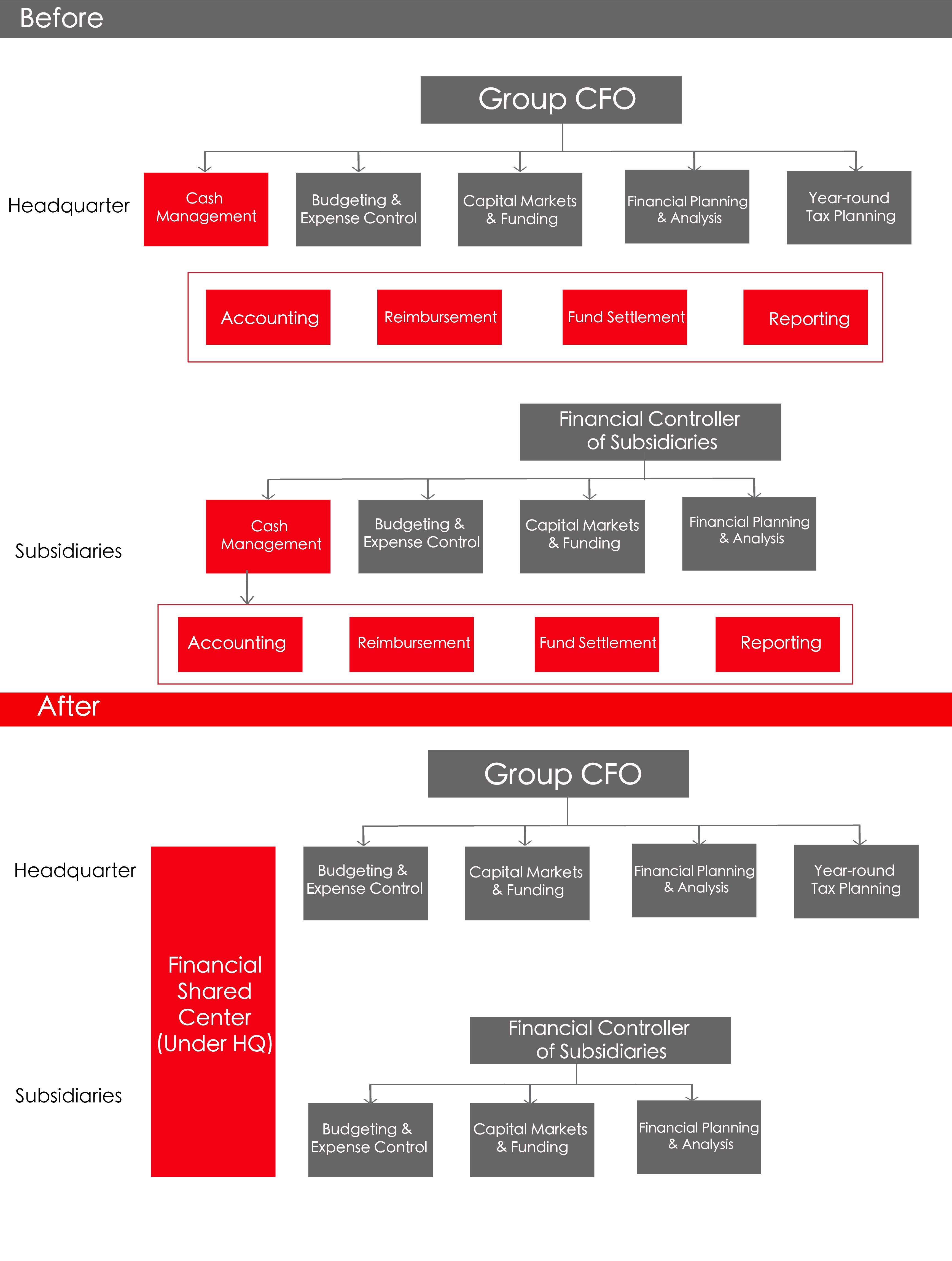

Changes are found in financial organisation structure and functions of the roles after the deployment of a shared service centre in a group enterprise.

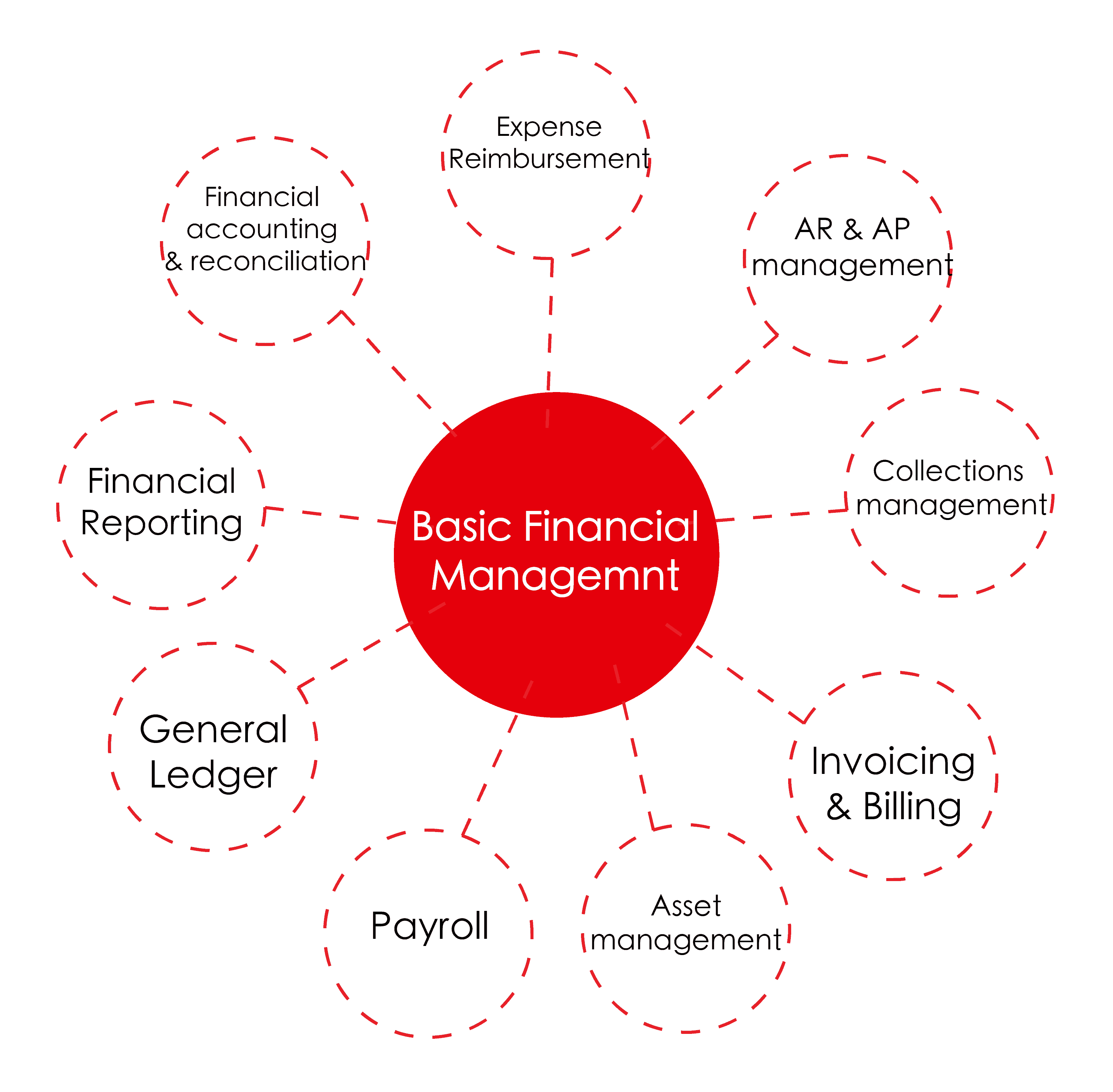

Basic accounting functions that can be included in the FSSC

Services to be shared: The mentioned 9 or more types of accounting functions can be included in the financial shared service centre, which will then be provided for all subsidiaries.

After setting up the FSSC: there will be zero cashier, zero accounting, zero books in subsidiaries.

Organisational attributes of the FSSC: The shared service centre is an independent organization within the group, and the form of expression can be a department, a division, or an independent company of the group.

Changes in business after setting up the FSSC: The financial processes has been changed— Originally, the subsidiary’s financial staff perform the approval process and now, the approval rights have been shifted to the staff in the FSSC.

Values brought by FSSC

Satisfy the enterprise strategic development

It is not necessary to increase the size of corporate financial team according to the unlimited business expansion, such as mergers and acquisitions

Strengthen control capability & process standardisation

The accounting functions and reportings of all the subsidiaries are performed by FSSC, which reinforce the group financial control. At the same time, it also promotes standardisation

Promote financial transformation & upgrade

The FSSC greatly increases the enterprise financial efficiency by professional division of labour and digitalisation. Resources can be allocated to managerial finance.

Support rapid business development

Enable subsidiaries to focus on business development instead of allocating resources on recurring accounting routine tasks. Accounting functions of the newly set up subsidiaries can be quickly carried out by the FSSC.

Reduce operating costs & improve efficiency

The FSSC adopts a specialized division of labor model to carry out financial work, which can greatly increase financial work efficiency and reduce finance manpower

Client stories

See how our clients are succeeding

Resources

Explore Your New Way of Working

Yonyou BIP Has Fully Launched Intelligent Services Based On DeepSeek Foundational Large Models

[dsm_breadcrumbs home_text="主頁" current_bottom="0px" _builder_version="4.27.0" _module_preset="default" current_font_size="1px" custom_margin_tablet="" custom_margin_phone="0px||0px||false|false" custom_margin_last_edited="on|phone" custom_padding_tablet=""...

White Paper on Globalization of Digital Operations for Chinese Enterprises

[dsm_breadcrumbs current_bottom="0px" _builder_version="4.16" _module_preset="default" current_font_size="1px" vertical_offset="34px" position_origin_a_tablet="" position_origin_a_phone="" position_origin_a_last_edited="on|phone" position_origin_f_tablet=""...

Tell us what you’re working to improve

Speak with sales at (852) 3907 3038, or send your enquiry to [email protected]