IFRS 16 is a new standard promulgated by the International Accounting Standards Board (IASB) to close the major accounting loophole from IAS 17: off-balance sheet operating leases. According to the document, any property or piece of equipment that a business has the right to use exclusively for a predetermined period of time will now be recognised as an asset and therefore included in the balance sheet.

The new leases standard, IFRS 16, could prompt significant changes to many businesses across a variety of industry sectors, especially retail, transportation, airline and banking.

IFRS 16 will change the company’s balance sheet, income statement and cash flow statement. Commonly used financial indicators will also change, which will affect the company’s “purchase or lease” decision.

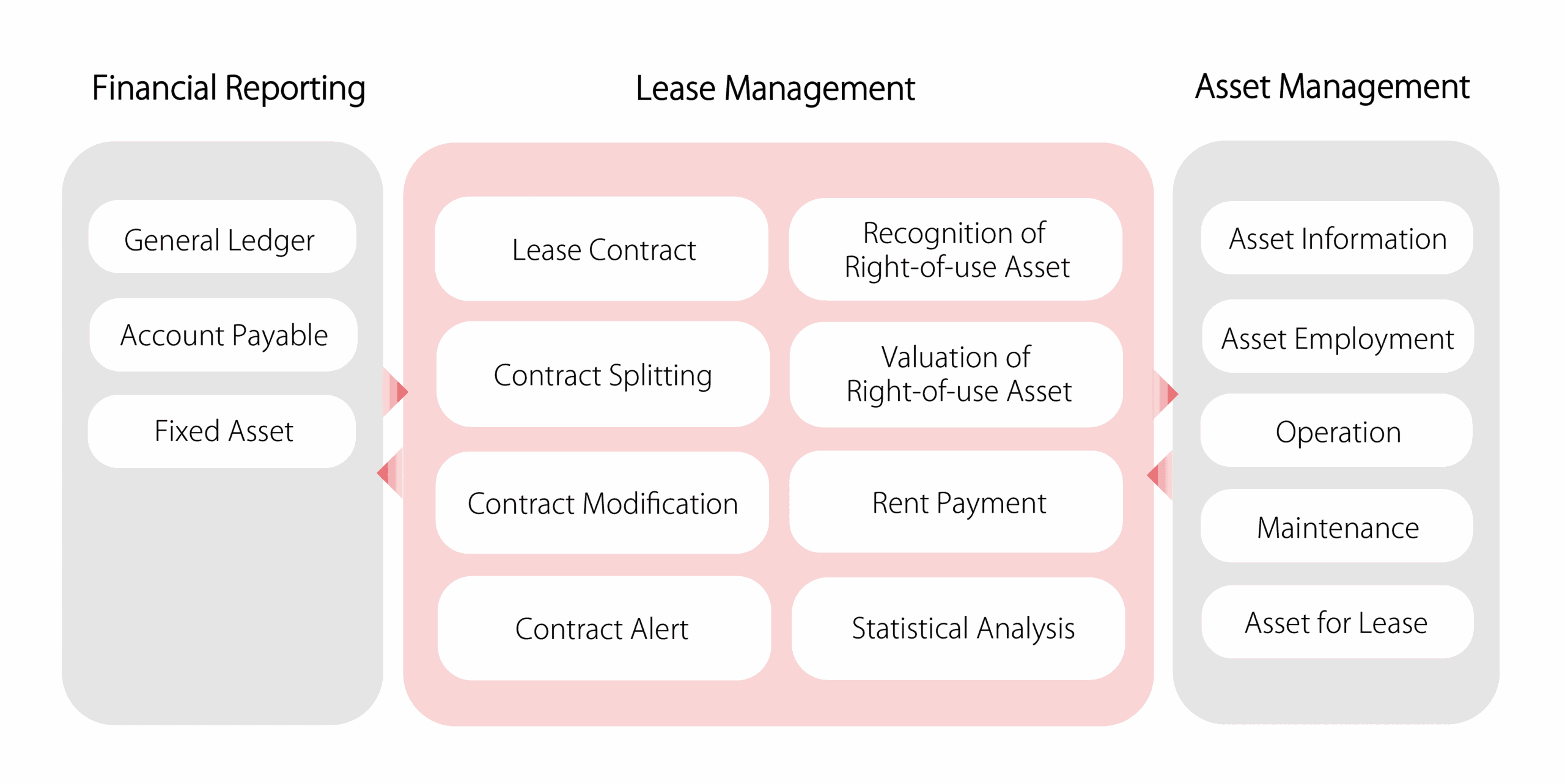

The new standard is required to collect a lot of information that was not in the financial reporting system in the past. Companies need to update their existing systems to collect lease-related information. yonyou’s IFRS 16 lease accounting solution connects financial reporting, leasing and fixed asset management, allowing companies to manage leasing business more effectively.

Fixed payments are payments that are made to the lessor by the lessee for the right to use an underlying asset during the lease term

Variable lease payments are the portion of payments during the lease term that varies because of circumstances occurring after the commencement date, other than the passage of time.

For example, the lease payments amount to X% of the store’s revenues.

The payments is calculated in respect of the leases under the framework agreement.

Usually applied in equipment rental, such as cars, photocopiers and computers, etc.

Explore the latest industry insights and download white paper reports

Recently, a No.5 Alarm fire occurred at Wang Fuk Court, resulting in casualties. The entire community of Hong Kong is deeply saddened. During this difficult time, we join all citizens in expressing our condolences, mourning the deceased, and extending our sincere sympathies to the affected families.

After careful assessment by the conference organizing committee, it has been decided that “The 1st (2025) International Summit on Digital-Intelligent Transformation in Finance and Accounting”, originally scheduled for December 3, 2025, will be postponed.

The new date for the event is January 12th, 2026 (Monday).

We believe that at this time when unity across society is needed, this decision shows respect for the deceased and is a responsible consideration of the current situation.

We sincerely apologize for any inconvenience this postponement may cause, and we greatly appreciate your understanding and support.